Bitcoin’s value is rising presently, showcasing the potential for further upside growth. Nevertheless, optimism and confidence within the largest cryptocurrency asset could be step by step reducing as long-term holders’ balances have fallen sharply prior to now few days.

Are Lengthy-term Holders Of Bitcoin Dropping Religion In The Asset?

Latest stories present a shift in traders’ sentiment resulting from Bitcoin’s long-term holders’ balances dropping to a brand new low in years. Main market intelligence and superior DeFi platform IntoTheBlock shared the event on the X (previously Twitter) platform, prompting hypothesis concerning the causes for the present dumping exercise.

This adverse sample factors to heightened profit-taking or strategic repositioning as the worth of Bitcoin fluctuates continuously. You will need to word that the steep decline in long-term holdings might impression market dynamics, probably influencing BTC’s value stability and indicating a change within the angle of seasoned investors.

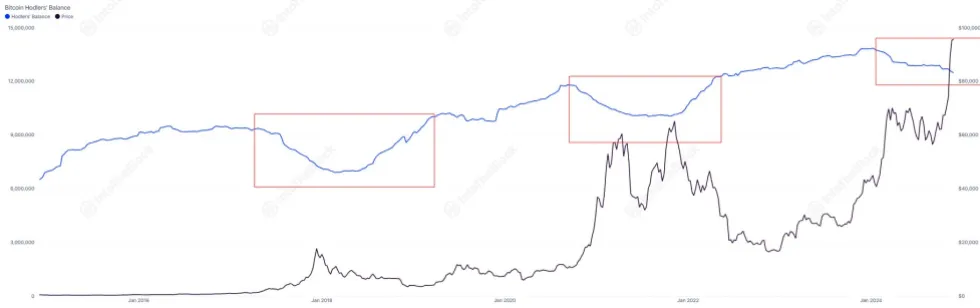

Based on IntoTheBlock, with a gentle lower of their holdings, the long-term Bitcoin holders presently personal about 12.45 million BTC, marking its lowest degree since July 2022, which displays diminished confidence within the digital asset amongst previous traders.

Additionally, the platform highlighted that this sharp decline is much less vital than in previous cycles. In contrast to previous cycles, whereby the long-term holders‘ balances fell by 15% and 26% in 2021 and 2017, respectively, this cycle has seen a decline of 9.8%, indicating much less impression on the asset’s worth than earlier ones.

Since a drop in long-term holder balances has been noticed to affect Bitcoin’s momentum over time, the event is now being carefully watched as a way to decide the short-term trajectory of BTC’s price and wider market ramifications.

Kyle Doops, a technical analyst and host of the Crypto Banter present, additionally pointed out a shift amongst long-term Bitcoin holders as they proceed to distribute giant quantities of the digital asset in gentle of value fluctuations.

The professional famous that there was a considerable outflow of over 507,000 BTC from long-term holders since September. Nevertheless, this huge outflow is far lower than the 934,000 BTC that was bought throughout the rally to the earlier all-time excessive in March this yr. On condition that this cautious promoting suggests rising religion in Bitcoin’s future potential, Kyle Doops claims the bulls may be getting began.

Bullish Sentiment Constructing Up For BTC

After a sudden drop on Tuesday to the crucial $93,000 threshold, a degree that has confirmed to be difficult for bulls, BTC has regained its upward energy, triggering a rebound to the $96,000 mark as soon as extra. This fast rebound displays its resiliency in intervals of waning market efficiency.

With a virtually 2% enhance within the final 24 hours, Bitcoin is presently buying and selling at $96,638, demonstrating indicators of extra features. Moreover, bullish sentiment appears to be growing towards BTC as its market cap and buying and selling quantity are slowly rising, recording 1.23% and 1.66% will increase, respectively, prior to now day.

Featured picture from Unsplash, chart from Tradingview.com