Bitcoin has skilled a whirlwind of volatility over the weekend, reaching the psychological $100K mark and a brand new all-time excessive of $103,600. Regardless of this milestone, the worth continues to wrestle to keep up ranges above $100K, elevating questions concerning the power of the present rally.

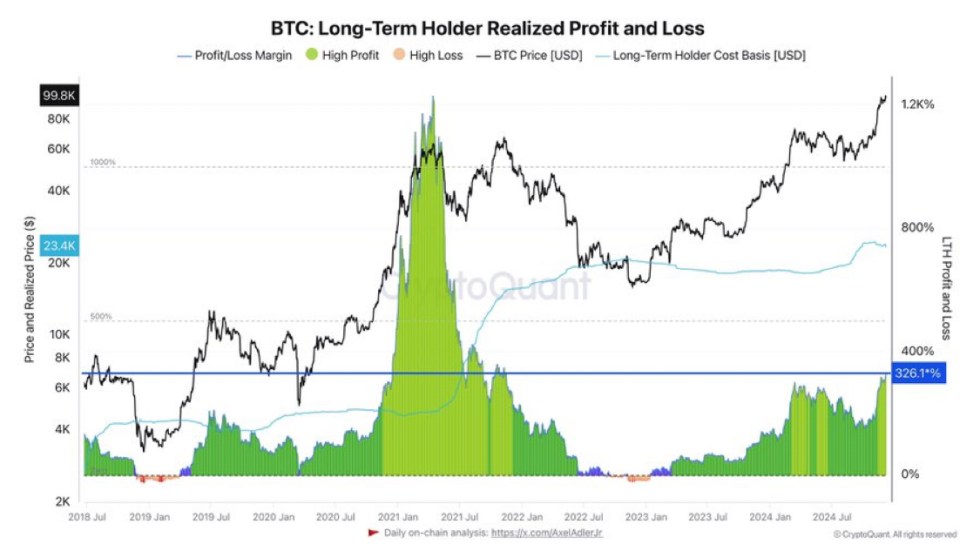

Metrics from CryptoQuant reveal a major development amongst Lengthy-Time period Holders (LTH), who’re actively taking income. These holders have a median buy value of $23.4K, realizing a formidable 326% acquire on their investments. Whereas this conduct displays confidence in locking in income at increased ranges, it might additionally sign warning, as such sell-offs have traditionally slowed momentum throughout bull runs.

This wave of promoting might spark issues amongst traders hoping for uninterrupted upward momentum. Some worry it could create resistance that hinders Bitcoin’s skill to maintain its ascent past the $100K threshold. On the similar time, it highlights the calculated methods of skilled market individuals, balancing optimism with prudence.

The approaching days shall be pivotal as BTC navigates this crucial juncture. Whether or not BTC reclaims its footing above $100K or succumbs to stress will form the broader market’s sentiment and decide the subsequent part of its historic bull cycle.

Demand Stays Robust

Bitcoin has been displaying spectacular demand, with the worth solely experiencing a ten% retrace up to now month after breaking the numerous $100,000 degree. This reveals that the momentum driving Bitcoin’s rise stays robust, and it’s solely a matter of time earlier than the cryptocurrency continues its push to new highs.

Analyst Axel Adler recently shared metrics that assist the continuing bullish development. One key statement is that Lengthy-Time period Holders (LTH) are actively promoting cash, realizing substantial income. These holders have a median buy value of $23.4K, and with present costs, they’re sitting on a formidable 326% acquire. As these LTHs dump their holdings, new traders are stepping in to soak up the availability, protecting demand excessive.

This dynamic highlights an important level: the continued provide from LTHs is prone to improve as their income develop. With such a major proportion of revenue being realized, extra LTHs will proceed to promote, which can gas additional market exercise. Nonetheless, this doesn’t sign a bearish development, as new traders are rapidly absorbing the availability, and the general demand for BTC is unwavering.

Given these elements, the BTC bull run seems to be simply getting began. As LTHs proceed to promote and extra recent capital enters the market, the stage is about for Bitcoin to push past present ranges and doubtlessly set new all-time highs. The continued demand, coupled with profit-taking conduct from long-term holders, means that the market is coming into a interval of sustained development.

Bitcoin Struggles Above $100k

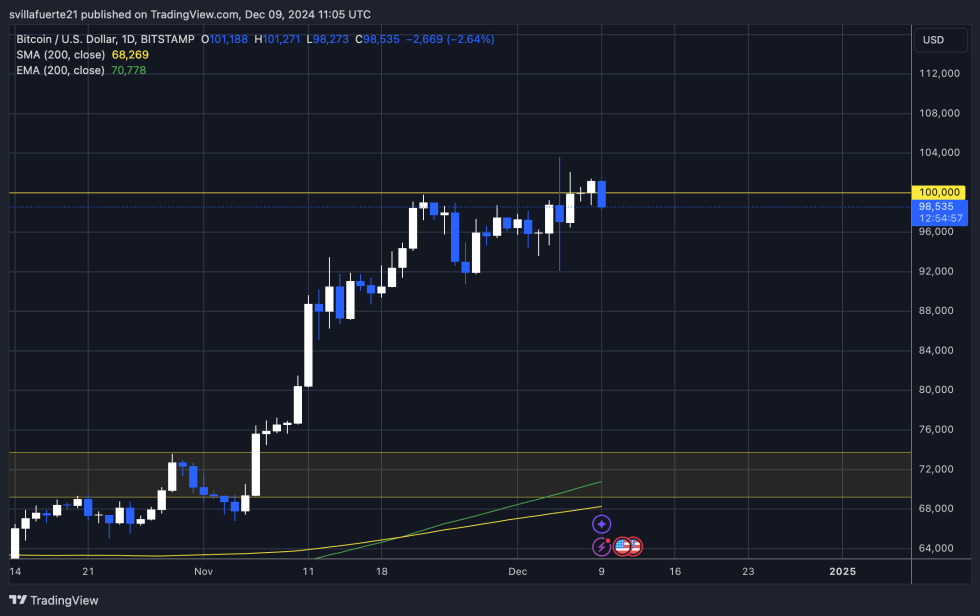

Bitcoin is presently buying and selling at $98,500 after failing to interrupt and maintain above the $100,000 degree 3 times in lower than per week. The repeated wrestle to keep up value above this key psychological degree has raised issues as BTC experiences elevated volatility.

This may very well be attributed to whales taking income after important positive factors, given the huge rise from the $60,000 vary. Nonetheless, if demand continues to push ahead and extra consumers enter the market, Bitcoin might lastly set up a stable foothold above $100,000.

The market’s response to this important degree is a transparent indication of ongoing market dynamics. If shopping for stress stays robust, BTC might see a sustained push above $100K, with a possible consolidation part above this mark. This might sign that Bitcoin’s upward development is much from over and that the market stays in a bullish cycle.

Merchants and traders shall be carefully monitoring these value actions within the coming days to gauge whether or not the $100,000 resistance turns right into a assist degree, paving the way in which for additional positive factors. In the end, continued demand from each retail and institutional traders might gas Bitcoin’s subsequent leg up, reaffirming its long-term bullish momentum.

Featured picture from Dall-E, chart from TradingView