After latest robust bullish performances by a number of altcoins, a number of analysts have tipped the altseason to have begun, constructing momentum for a serious value explosion within the coming weeks. Curiously, in style analyst EGRAG Crypto has weighed in on the discourse round a highly-anticipated altseason, predicting a possible market influx of $627 billion.

Bitcoin Dominance To Crash By 33% As Altcoins Fly – Analyst

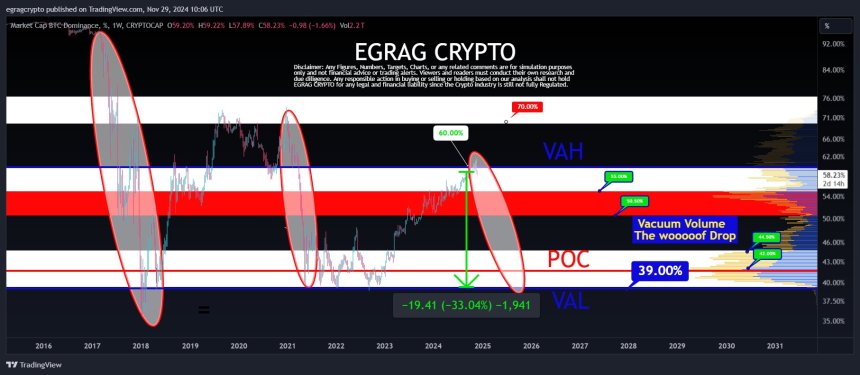

In an X post on Friday, EGRAG Crypto offered invaluable perception available on the market progress potential of altcoins within the upcoming altseason. The analyst employed the Quantity Vary Seen Profile (VRVP), an evaluation instrument to establish key assist and resistance ranges based mostly on buying and selling quantity, to review the buying and selling exercise of Bitcoin throughout completely different dominance ranges.

For context, the alt season is a interval the place altcoins considerably outperform Bitcoin by way of value appreciation. It’s characterised by a relative decline in Bitcoin’s market share as capital strikes into different cryptocurrencies.

As proven within the weekly chart under, EGRAG Crypto notes that Bitcoin’s dominance is closing under its Worth Space Excessive (VAH) i.e. the higher boundary of heavy buying and selling exercise which presently acts as a resistance zone.

This improvement is especially bullish for altcoins because it indicators growing promoting stress on Bitcoin which can weaken its dominance over different property. Importantly, EGRAG Crypto additionally highlights the Worth Space Low (VAL) i.e. decrease boundary of heavy buying and selling exercise which is prone to act as assist and goal degree for Bitcoin dominance on this altseason.

In response to values drawn by the analyst, BTC Dominance will decline by 33.04% if it reaches its Worth Space Low. Due to this fact, contemplating Bitcoin’s present market cap of $1.91 trillion, the altcoins are prone to document new inflows of $627 billion within the forthcoming weeks.

As well as, EGRAG Crypto additionally states Bitcoin Dominance could have a Level of Management (POC) goal of 42% on this altseason. The POC represents a pivotal value/dominance degree with essentially the most buying and selling quantity and a decline under which indicators a confirmative shift in market curiosity from Bitcoin to different cryptocurrencies.

Ethereum Stays Key To Altseason Cost

With extra knowledgeable commentary on the altseason, analyst Michaël Van de Poppe has appraised the constructive value performances of altcoins prior to now month. Moreover, the analyst states that if Ethereum (ETH), the most important altcoin by market cap, closes above 0.035 on the ETH/BTC chart for November, it should recommend a robust bullish interval for altcoins in December.

On the time of writing, the altcoin market stays valued at $1.39 trillion representing 41.4% of the whole crypto market cap.